Cfd trading meaning

This means that you can easily take a position on rising and falling markets. CFDs are a leveraged product, which allows you to put down a small amount of money, known as a margin, and trade with a larger sum Versus Trade.

Setting up useful indicators can be a massive help with technical analysis CFD trading strategies. Investors can set support levels that are equal to established lows and resistance levels that are equal to established highs.

Hedging could be seen as a form of insurance to safeguard a trader’s or investor’s portfolio when a financial instrument’s price might be about to fall; however, they don’t want to sell their asset yet.

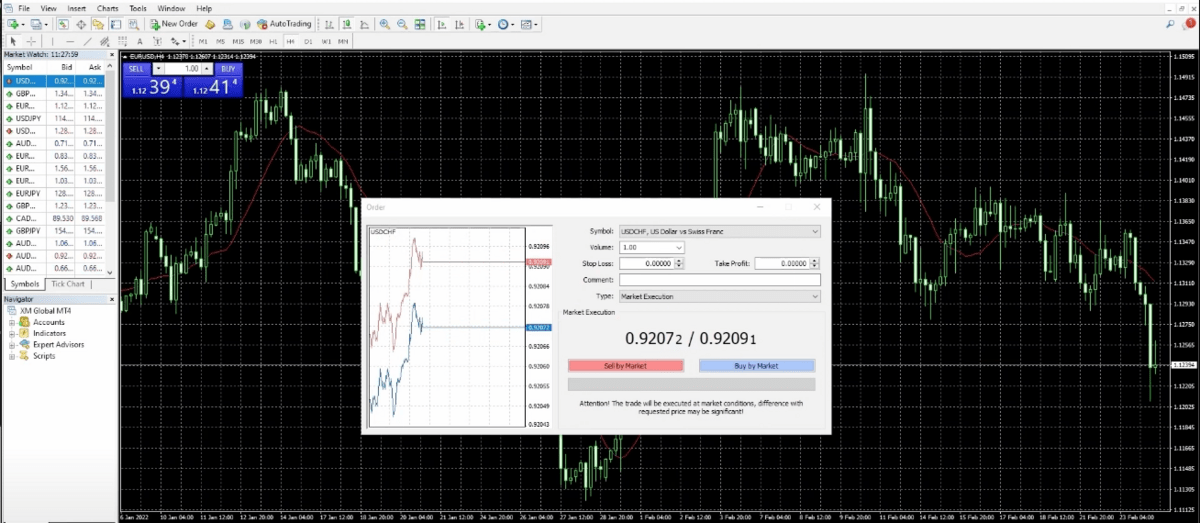

Cfd trading platform

Successful CFD traders are able to show a profit over a large volume of trades, over long stretches of time. They do so by incorporating trading styles that minimize risk and strategies that aim to keep their average losses low relative to their average profits (though this is easier said than done).

FOREX.com is a trusted brand that delivers an excellent trading experience for forex and CFDs traders across the globe. It offers a wide range of markets and provides an impressive suite of proprietary platforms – alongside limited access to MetaTrader. Read full review

Choosing the best CFD trading platform for you depends on your location, and your broker’s rules. Interactive Brokers is the best CFD broker for most experienced CFD traders; eToro is the best CFD broker for most beginner CFD traders.

The best beginner’s platform for CFD trading is also eToro. If you’re new to CFD trading, the eToro Academy provides a common sense introduction to the strategy. CopyTrader gives you the chance to see how successful traders trade CFDs.

Steven Hatzakis has been reviewing forex brokers for nearly ten years and has 25+ years of experience as a forex trader. His broker reviews are unbiased and independent, and his expertise is sought after for global FX conferences and speaking events around the world. Learn how we test.

WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Information is provided ‘as-is’ and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.

Bitcoin cfd trading

We use cookies to give you the best possible browsing experience. By continuing to use the website, you consent to the use of cookies. You may withdraw your consent at any time – see our Cookie Policy for further details.

The best Bitcoin CFD brokers to use in 2024 include Plus500, eToro, Oanda, AvaTrade and Pepperstone. Each of these providers offer charting tools and analysis features that are ideal for active traders who want to take advantage of short-time price fluctuations.

In this guide, you’ll learn more about Bitcoin, CFD trading, and the best platforms for trading Bitcoin. We’ll take a closer look at the best Bitcoin CFD brokers to determine which options are the best to consider in 2024.

Crypto CFDs allow traders to speculate on both rising and falling prices. Whether you expect Bitcoin to soar to new highs or anticipate a market downturn, you can take a long or short position accordingly. This flexibility ensures trading opportunities in all market conditions.

CFDs (Contracts for Difference) and ETFs (Exchange-Traded Funds) are two distinct financial instruments, each catering to different trading objectives. A CFD is a derivative that allows traders to speculate on the price movements of an asset without owning it. CFDs are typically used for short-term trading and offer the flexibility to profit from both rising and falling markets through leverage. However, this leverage can amplify both gains and losses, making risk management essential.